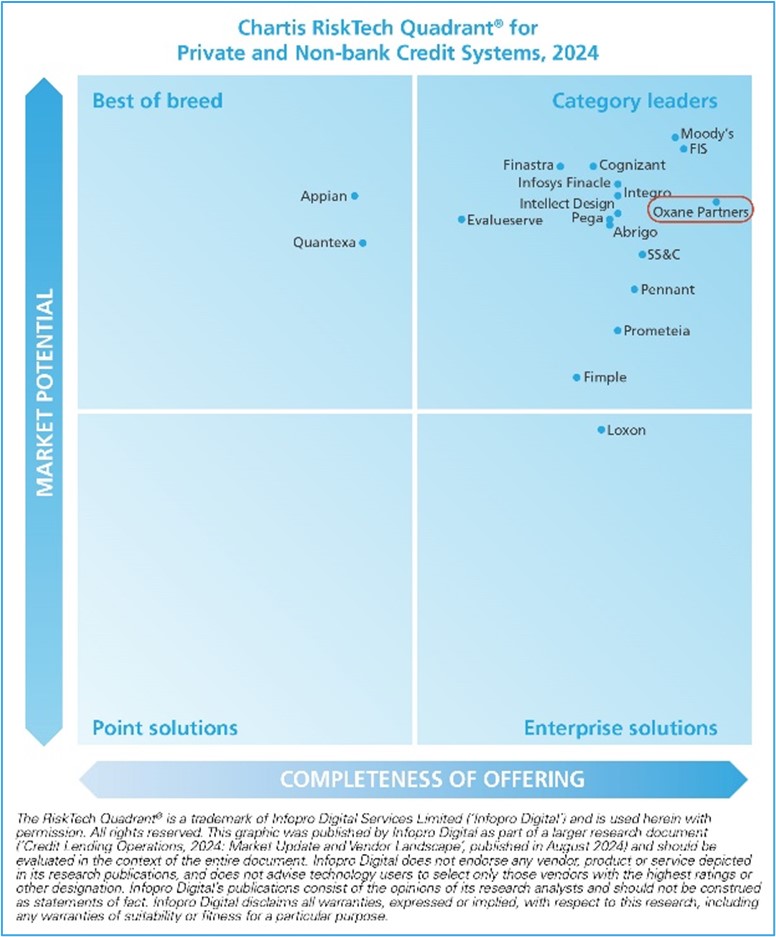

Oxane Recognised as a ‘Category Leader’

in multiple RiskTech Quadrant Reports

Key Highlights:

- Oxane was named a ‘Category Leader’ in four quadrants of Chartis' Credit Lending Operations 2024 Report, including Non-Bank and Private Credit Solutions, Loan Origination, Collateral Management, and Limits Management Systems.

- Ranked #61 in the Chartis RiskTech100 2025 Report and retained ‘Category Leader’ status in Credit Portfolio Management Solutions for the second year in a row.

- These accolades illustrate Oxane’s market-leading position in lending and credit portfolio management technology and recognise its capabilities across the entire lending life cycle for global investment banks, private credit funds, and institutional asset managers.

London, New York: 28 February 2025

Oxane Partners ("Oxane"), a leading technology-driven solutions provider to private credit+ markets, announced multiple new recognitions by Chartis Research across its suite of solutions. Oxane was positioned among the industry leaders in multiple RiskTech Quadrant Reports including being named a “Category Leader” four times in Chartis Research’s Credit Lending Operations 2024 report.

According to Chartis, Category Leaders exhibit a clear strategy for sustainable growth, combined with best-in-class technology and broad sector coverage. Oxane’s positioning reflects its strengths in portfolio monitoring, credit risk management, loan origination, limits management, and AI-powered analytics - validated by customer feedback and market potential.

“As private credit expands, investment firms are prioritising technology initiatives to enhance portfolio and risk management," said, Mr. Sumit Gupta, Co-founder and Managing Director, Oxane Partners. Continuing further, Mr. Gupta added, "It's humbling to witness our consistent efforts being recognised by the industry. At Oxane, we are continuously investing in capabilities that allow our clients to have better control over their credit investment and lending operations as they scale up."

Kanav Kalia, Chief Sales and Marketing Officer at Oxane highlighted, “For over a decade now, our laser-focus on private credit with our Oxane Panorama suite of solutions has enabled our clients to achieve scale and control over their investment operations. Our position in the private credit quadrant serves as a strong validation of the impact our solutions are creating for clients and the industry at large."

These recognitions reinforce Oxane’s leadership in private credit solutions, trusted by the top-20 global investment banks, top-15 private credit firms, and top-10 institutional asset managers.

To access Chartis’ Credit Lending Operations Report and learn more about RiskTech Quadrant®, click here.

About Oxane Partners:

Oxane Partners is a leading provider of technology-driven solutions to the private credit industry. Our solutions transform the way investment firms and banks analyse and manage their investments. We unify our technology with deep domain expertise to provide compelling solutions to the challenges faced by the private markets industry.

Our solutions manage over $500 billion of notional for 100+ clients including global investment banks, private credit, private equity, hedge funds, and alternative asset managers. With offices in London, New York, Gurgaon, and Hyderabad our team of 500+ supports clients in more than 20 geographies globally.

Founded in 2014 by former structured credit investment professionals at Deutsche Bank, Oxane Partners is at the forefront of the digital transformation that is underway in the private markets industry. For more information, please visit https://oxanepartners.com.

Press contact

Gurneet Singh

Marketing Communications

gurneet.singh@oxanepartners.com

UK: +44 (20) 7993 6893

US:+1 347 329 4561

IN: +91 797 345 2806