In the years since the global financial crisis, private credit has been one of the fastest growing segments of the alternatives market.

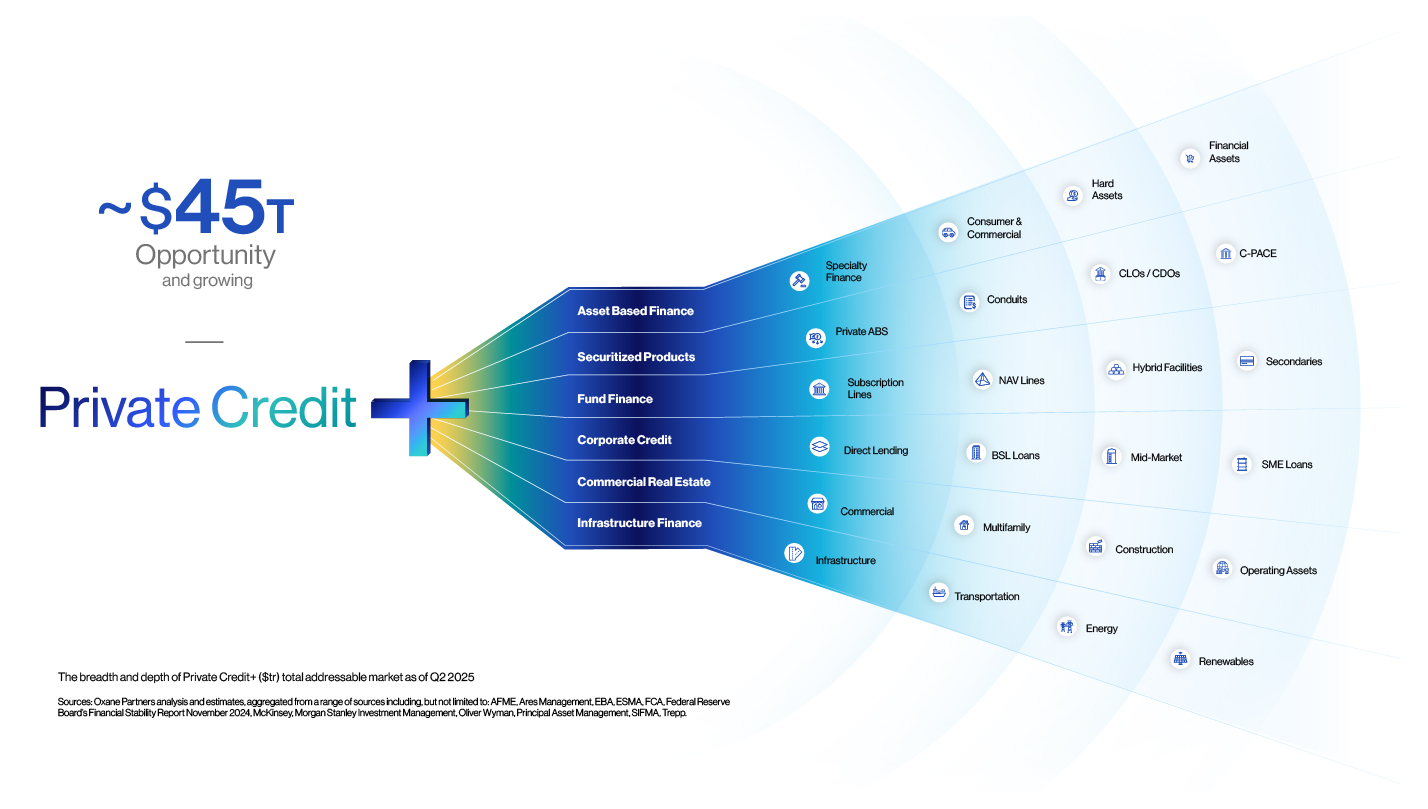

Private credit has expanded far beyond corporate direct lending into a much broader opportunity set – we are calling it Private Credit+, one that's more than 30 times larger when viewed beyond the limited purview of direct lending.

Asset-based finance, securitized products, commercial real estate finance, infrastructure finance, and fund finance – each of these asset classes represent a fast-moving component of Private Credit+.

Private Credit+ presents a monumental opportunity, and capitalizing on this requires a strategic rethink to manage scale, risk, and operational controls.

Unpacking the Private Credit+ Opportunity

Our perspective on Private Credit+

The $45 Trillion Opportunity

Private Credit+ unshackles private credit from the limited scope of direct lending to an opportunity that is orders of magnitude larger. When viewed through the Private Credit+ lens, the total addressable market expands to $45 trillion by our estimates - more than 30 times larger

Private Credit+ isn’t just private credit.

Commercial real estate finance, asset-based finance, infrastructure finance, structured credit, securitized products, and fund finance — these are not merely segments of Private Credit; they are the key pillars of Private Credit+. Each asset class fuels a broader, more dynamic ecosystem that transcends traditional boundaries

It's a market redefinition, not an expansion

As the private credit landscape evolves, the emergence of diverse asset classes — from asset-based finance and securitized products to fund finance, corporate credit, commercial real estate, and infrastructure finance — has fundamentally reshaped the expectations of lenders and sponsors. This transformation demands a financing architecture that is as flexible as it is sophisticated, capable of adapting to varied risk profiles and collateral types

Download Report